Insight M

Faster, cheaper aerial imaging of methane leaks for the oil and gas industry

Kairos Aerospace not only pinpoints leaks, but also equips owners and operators of oil and gas infrastructure with the data and strategy they need to pragmatically manage their methane emissions — enabling them to fix leaks quickly and profitably, which has a massive positive impact on the climate. We’ve backed Kairos since 2016, and over that time, oil and gas producers, legislators, and federal and state regulators have come to recognize that methane leaks from wells and pipelines are a major source of greenhouse gas emissions that must be monitored and mitigated — and we’ve been proud to watch the company scale to keep up with the new demand for insights about these releases.

Kairos is changing its name to Insight M to reflect its central focus on helping oil and gas companies manage their methane emissions. This week they announced their $52 million Series D to continue the company’s growth. Funds and accounts managed by BlackRock led the round, alongside Hartree Partners and existing investors Climate Investment and Energy Innovation Capital. We at DCVC were also pleased to invest.

Why? Because molecule for molecule, methane is 80 times more potent than CO2 in terms of warming the Earth, over a 20-year period. Anthropogenic methane is responsible for up to 30 percent of the rise in global temperatures since the industrial revolution. Millions of metric tons of the gas escape into the air every year, due to leaks from oil and natural infrastructure, as well as from agriculture (the other major source of anthropogenic methane). But methane is odorless and invisible to the naked eye, so measuring and controlling emissions requires dedicated detectors located either on the ground at production or processing facilities or flying overhead on satellites or aircraft.

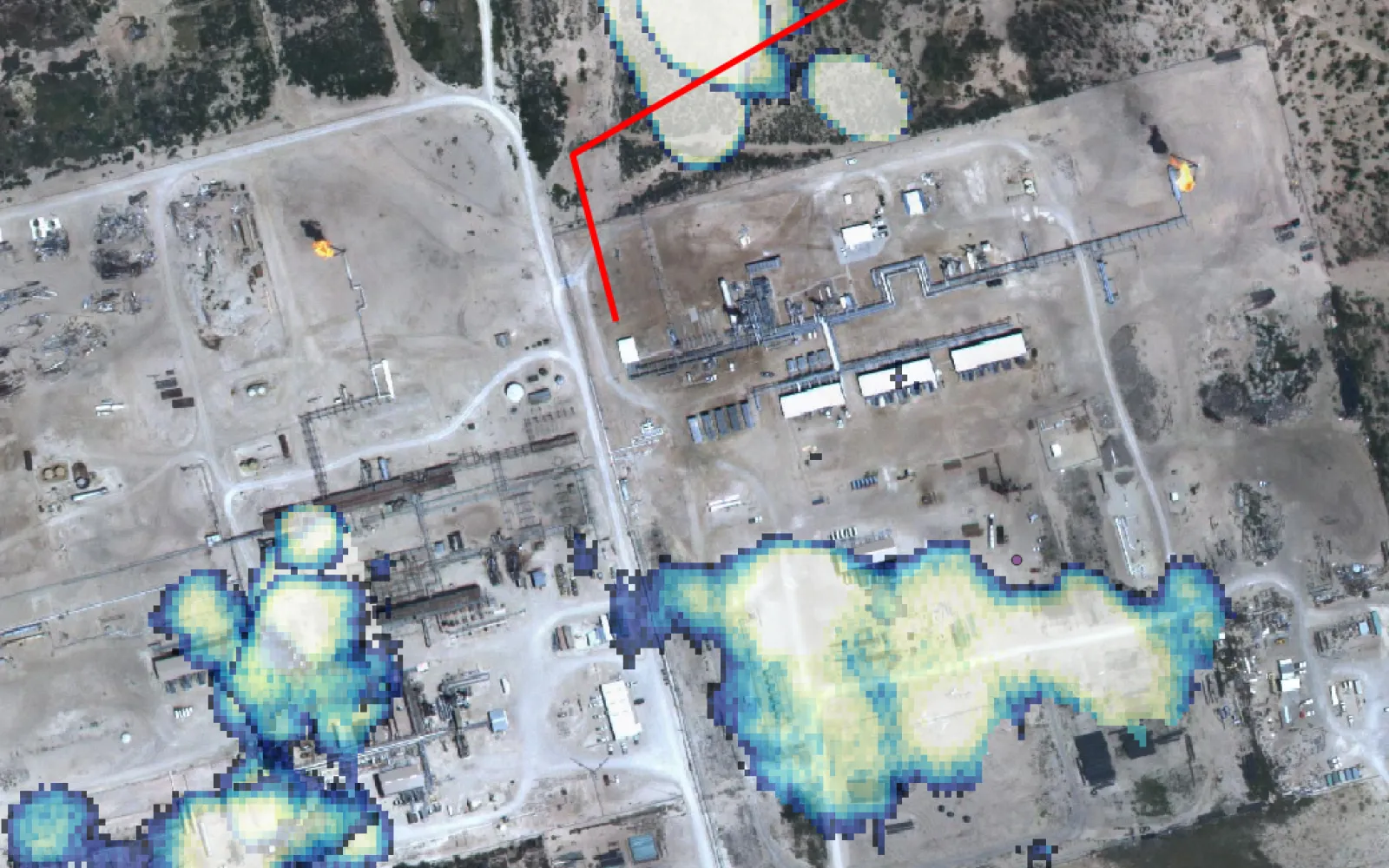

Insight M is the leader in aerial methane detection. The company’s proprietary spectrometers measure the absorption of reflected sunlight by methane molecules. Insight M mounts these devices on small planes and conducts frequent flights over entire oil and gas basins, such as the Permian Basin in West Central Texas and southeastern New Mexico, covering up to 100 square miles per plane per day. Their team crunches the data to pinpoint the location and quantify the scale of each leak. Because the flights are so frequent and cover so much territory, “We have a mountain of data on methane emissions that nobody else has,” says Gregg Rotenberg, the company’s CEO. “This data enables us to provide a comprehensive solution to oil and gas companies — not only do we help them pinpoint their emissions, but we also offer scientifically rigorous tools that help them choose the methane management strategy that best aligns with their business goals.”

The timing of Insight M’s scale-up could not be more perfect. The company is increasing its data-gathering capacity at the exact moment when the Environmental Protection Agency is detailing how it proposes to implement annual waste methane emission charges, which were written into the Inflation Reduction Act of 2022 to incentivize operators to prevent leaks. Operators of both new and existing facilities must now regularly inspect for leaks, using either traditional ground-based sensors or advanced methods such as Insight M’s aerial flyovers. When emissions exceed the EPA’s threshold, companies will have to pay $900 per metric ton of methane beginning this year, escalating to $1,500 in 2026. Because most operators have underestimated their leak rates in the past, total methane fees could be surprisingly high, potentially mounting into the billions of dollars per year across the industry.

The charges will be based on self-reported emissions figures, but companies will now have to use EPA-approved measuring technologies. (Insight M is working hard behind the scenes to get its data gathering system certified by the EPA.) But there’s a twist: rules announced in late 2023 give third parties, such as environmental NGOs and scientific organizations, a way to report so-called super emitters. Operators will be required to investigate these third-party reports and include the leaks in the totals used to calculate the waste emissions charges. The Super Emitter Program means, in effect, that oil and gas companies can’t afford not to know about their own emissions. Insight M won’t participate in the Super Emitter program, and never provides customer data to third parties.

Insight M’s high-frequency surveys excel at spotting the medium-to-large leaks that constitute the bulk of the methane emissions problem, and that push operators into super emitter territory. They can also help oil and gas operators see how they rank compared to their peers, and prove to stakeholders that they’re meeting environmental goals, thus lowering the cost of capital.

With its new capital infusion, Insight M will be able to stay at the cutting edge of methane detection and strategic management, while growing its sales and operations teams to meet exploding demand. That, in turn, will help Insight M’s customers curtail millions of tons of methane emissions — which is ultimately one of the easiest, fastest, and cheapest paths toward curbing global warming.

Zachary Bogue is Co-Founder and Managing Partner at DCVC.